closed end fund liquidity risk

J Pol Econ 111642685. In October 2016 the US SEC adopted new rules designed.

Bafin Expert Articles Investment Funds Dealing With Liquidity Risks

Investment constraints such as risk tolerance liquidity needs and investment time horizon should be taken into consideration.

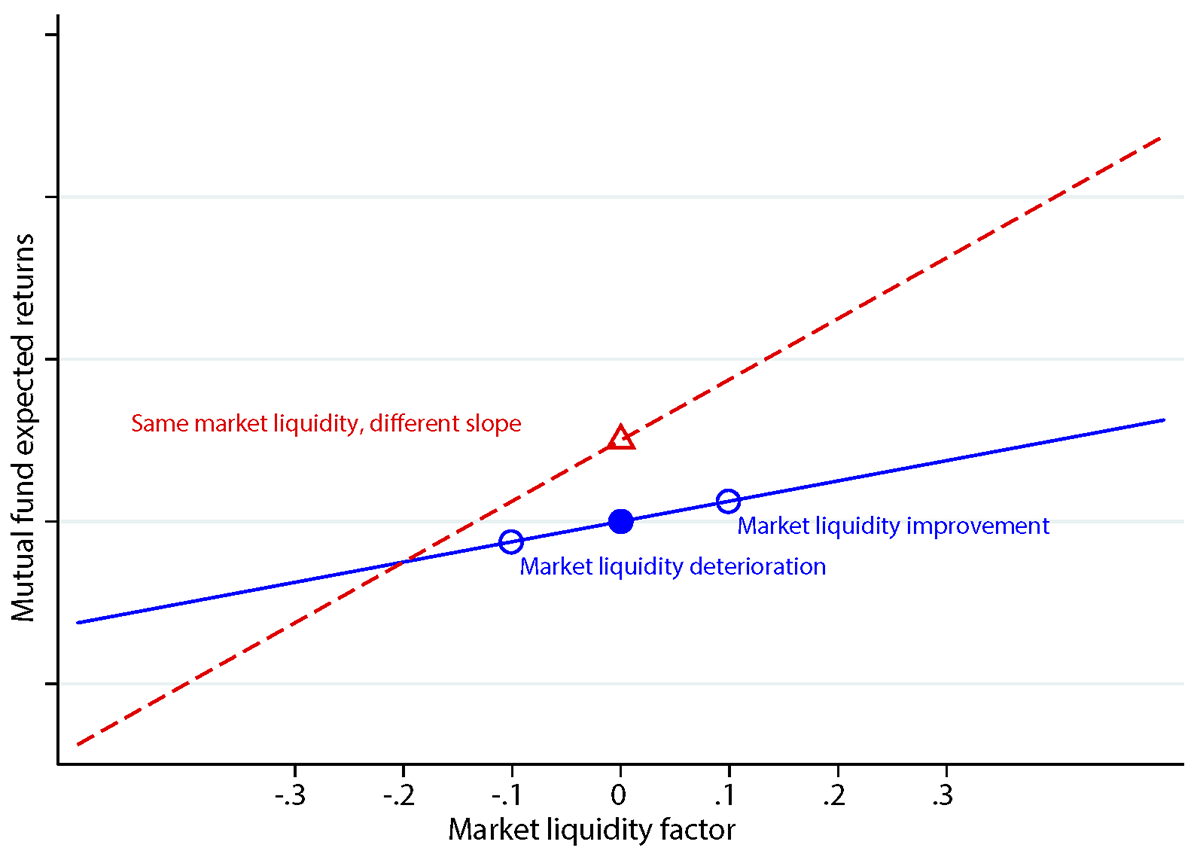

. Pastor L Stambaugh RF 2003 Liquidity risk and expected stock returns. 2 permit a fund to use swing pricing under certain circumstances. Also some of the closed-end funds invest in less liquid assets so they can experience internal liquidity problems in times of market unrest.

There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. View important footnotes disclosures. Liquidity Liquidity Risk and the Closed-End Fund Discount David Manzler University of Cincinnati College of Business Department of Finance Cincinnati OH 45221-0195 513-556-7087.

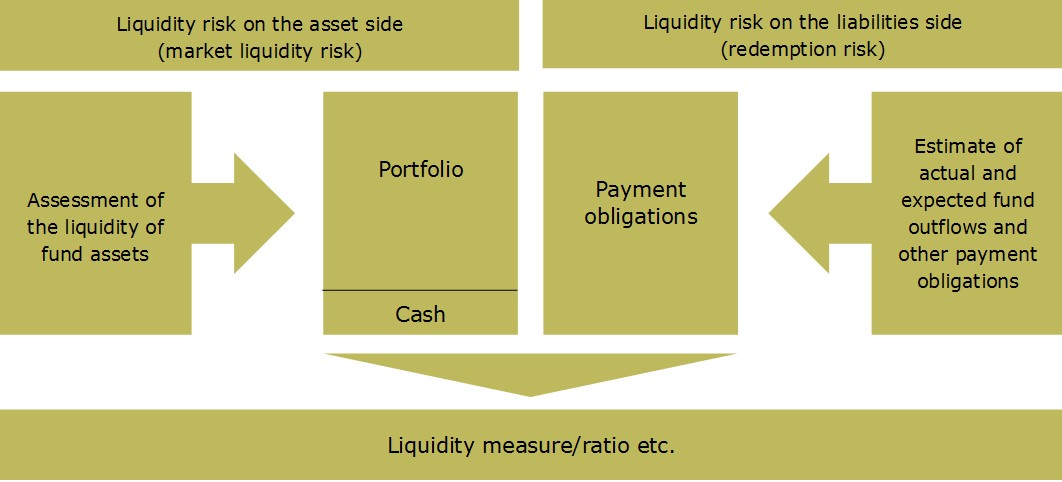

CrossRef Google Scholar Pontiff J 1997 Excess volatility and closed-end. Open-end funds to establish a liquidity risk management framework tailored to its specific portfolio and risks. The SEC adopted Rule 22e-4 the Liquidity Rule requiring each registered open-end fund including open-end ETFs but not money market funds to establish a liquidity risk.

Listed CEFs can offer intra-day liquidity. Buy CEFs at larger than normal discounts to NAV and sell them when the discounts. The closed-end fund has the ability to go into less liquid because it doesnt have that 15 distinction.

The use of leverage by a. George uses the following investment strategies1 Opportunistic Closed-end fund investing. Like a mutual fund a closed-end.

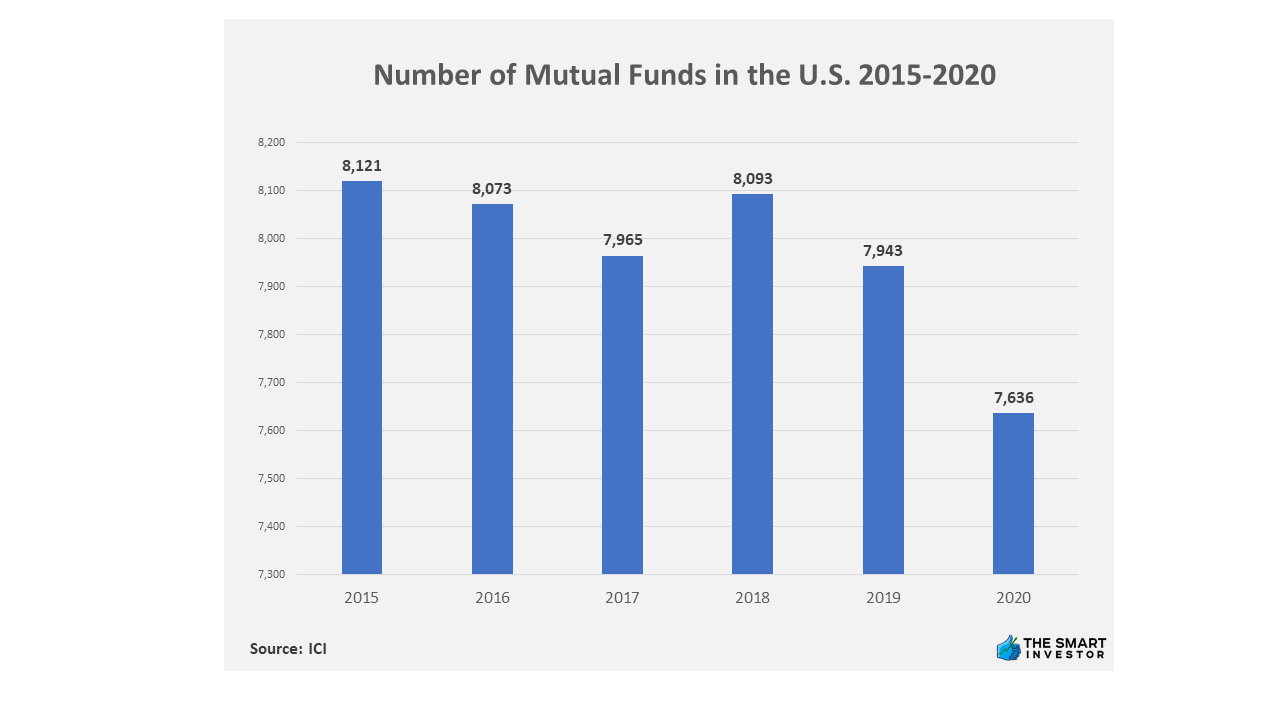

According to the 2018 Investment Company Fact Book the total asset value of the 530 closed-end funds that existed at the end of 2017 was 275 billion. Unlisted closed-end funds also provide limited liquidity. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income.

The SECs Division of Investment Management is happy to assist small entities with questions regarding the liquidity risk management rules. Unlisted closed-end funds also provide limited liquidity. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small.

Download Citation The Empirical Study of Liquidity Risk and Closed-End Fund Discounts Based on Panel-Data Within the bounds created by limits to arbitrage and the. Questions may be directed to the. Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the.

A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. These high-risk stocks are. The term feature ensures NAV liquidity upon maturity.

Closed-end funds are considered a riskier choice because. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the. If you invested five.

Open-ended Fund Liquidity and Risk Management Good Practices and Issues for Consideration.

Closed End Funds Basics How It Works Pros Cons The Smart Investor

A Closer Look At Closed End Funds Fundx Insights

How Illiquid Open End Funds Can Amplify Shocks And Destabilize Asset Prices

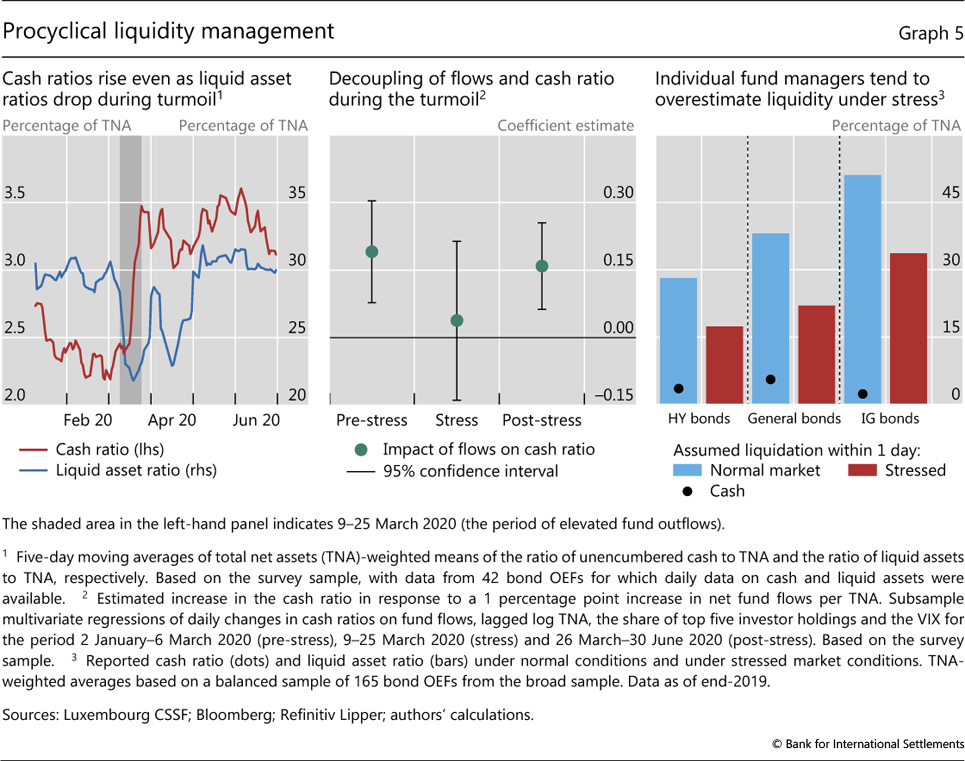

Open Ended Bond Funds Systemic Risks And Policy Implications

What Are Closed End Funds Forbes Advisor

Solved A The Liquidity Problems In Managed Funds Are Chegg Com

A Guide To Investing In Closed End Funds Cefs

Flowpoint Partners Llc On Twitter 4 22e 4 Aimed To Reduce Liquidity Risk Defined As The Risk That A Fund Could Not Meet Redemptions Without Significant Dilution Of Remaining Investors Interests In The

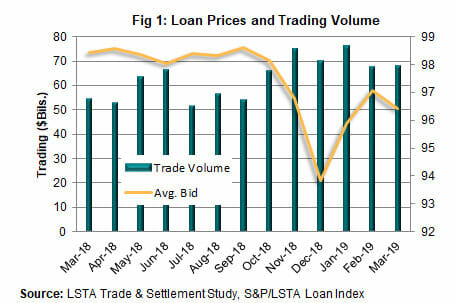

Loan Mutual Fund Liquidity Risk Management A Case Study Lsta

Key Concepts Of Closed End Funds Nuveen

:max_bytes(150000):strip_icc()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Tap Illiquid Markets W Closed End Funds Aspiriant Wealth Management

A Guide To Investing In Closed End Funds Cefs

Emerging Market Closed End Funds List Emerging Market Skeptic

Financial Stability Oversight Council Press Release Friday 2 4 Potential Risks To U S Financial Stability Arising From Open End Funds Particulary Their Liquidity And Redemption Features The Xrt Etf Is An Open End Fund

Money Market Funds Liquidity Risk Management Frameworks Offer Insights For Other Open End Funds

Liquidity Transformation And Open End Funds Money Banking And Financial Markets

A Closer Look At Closed End Funds Fundx Insights

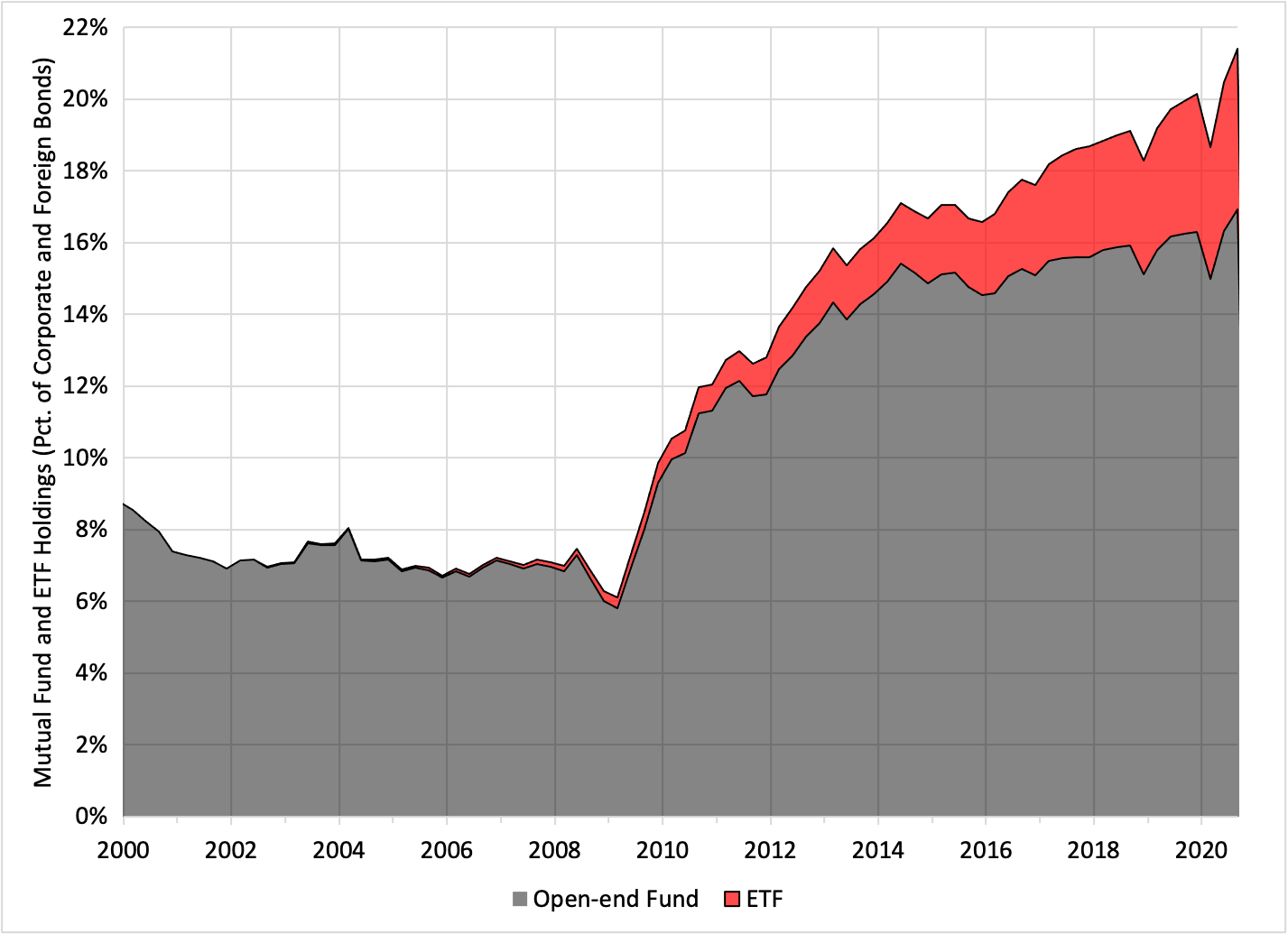

Open End Funds Vs Etfs Lessons From The Covid Stress Test Money Banking And Financial Markets